One of the biggest opportunities in collections and recoveries operations is to create an engaging and supportive approach to support customers in arrears, driving a great customer experience that supports customer retention with your brand.

One of the biggest opportunities in collections and recoveries operations is to create an engaging and supportive approach to support customers in arrears, driving a great customer experience that supports customer retention with your brand.

Digital communication is more important than ever within the collections and recoveries sector where customer engagement is at a premium. Recent data has shown that we have jumped forward about 5 years in consumer and business digital adoption since the start of the COVID pandemic.

The latest insights suggest that 75% of ‘new digital’ adopters will continue to use digital channels and this wave of ‘new digital’ customers will create a new expectation from consumers who will demand the ability to engage digitally.

of SMS delivered are opened.

of mobile phone users check their phones within 30 minutes of waking up.

make online purchases and pay bills online.

Integration and setup:

Delivery options:

Through implementing our platform, our clients have seen increased profitability through –

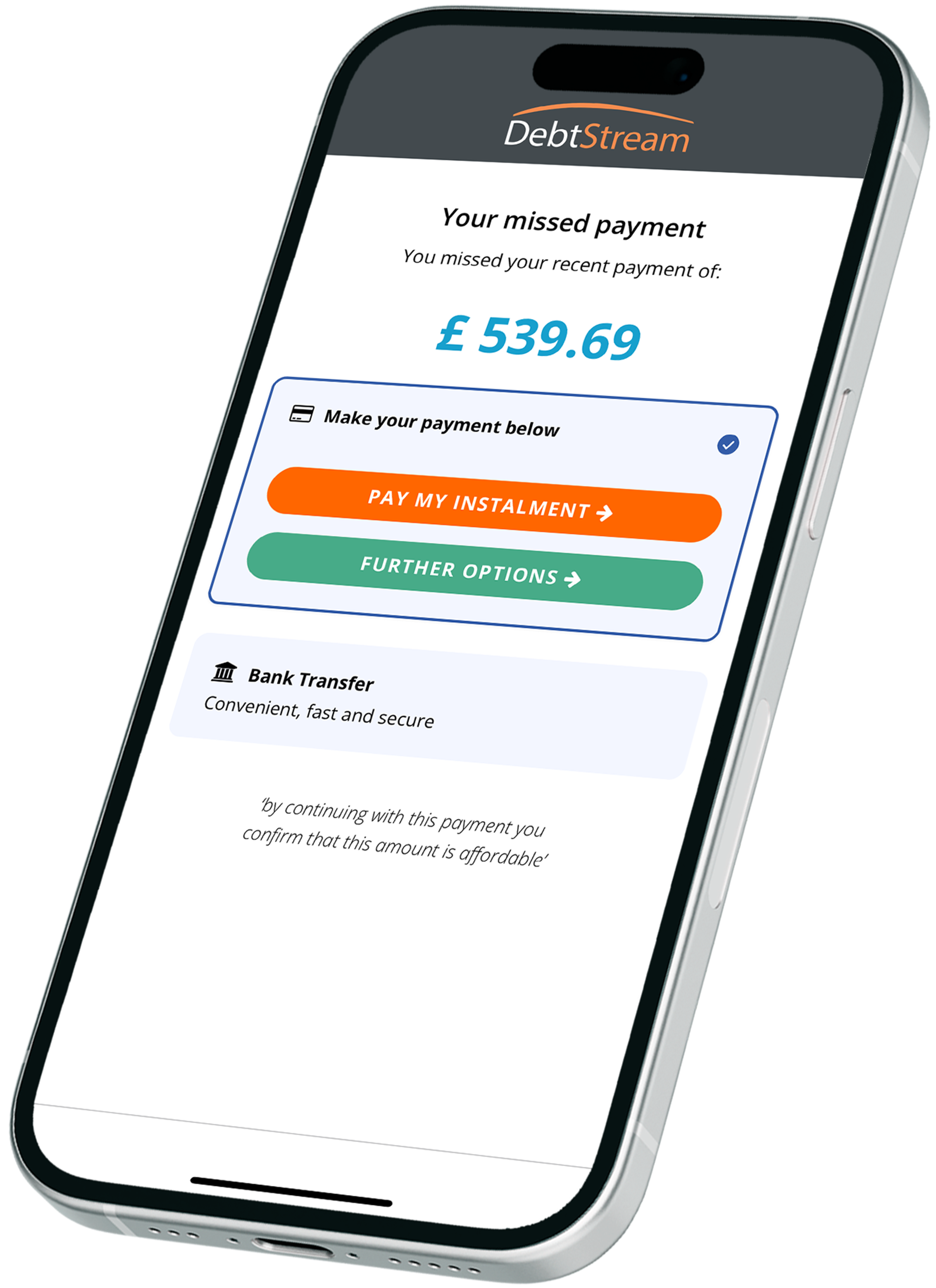

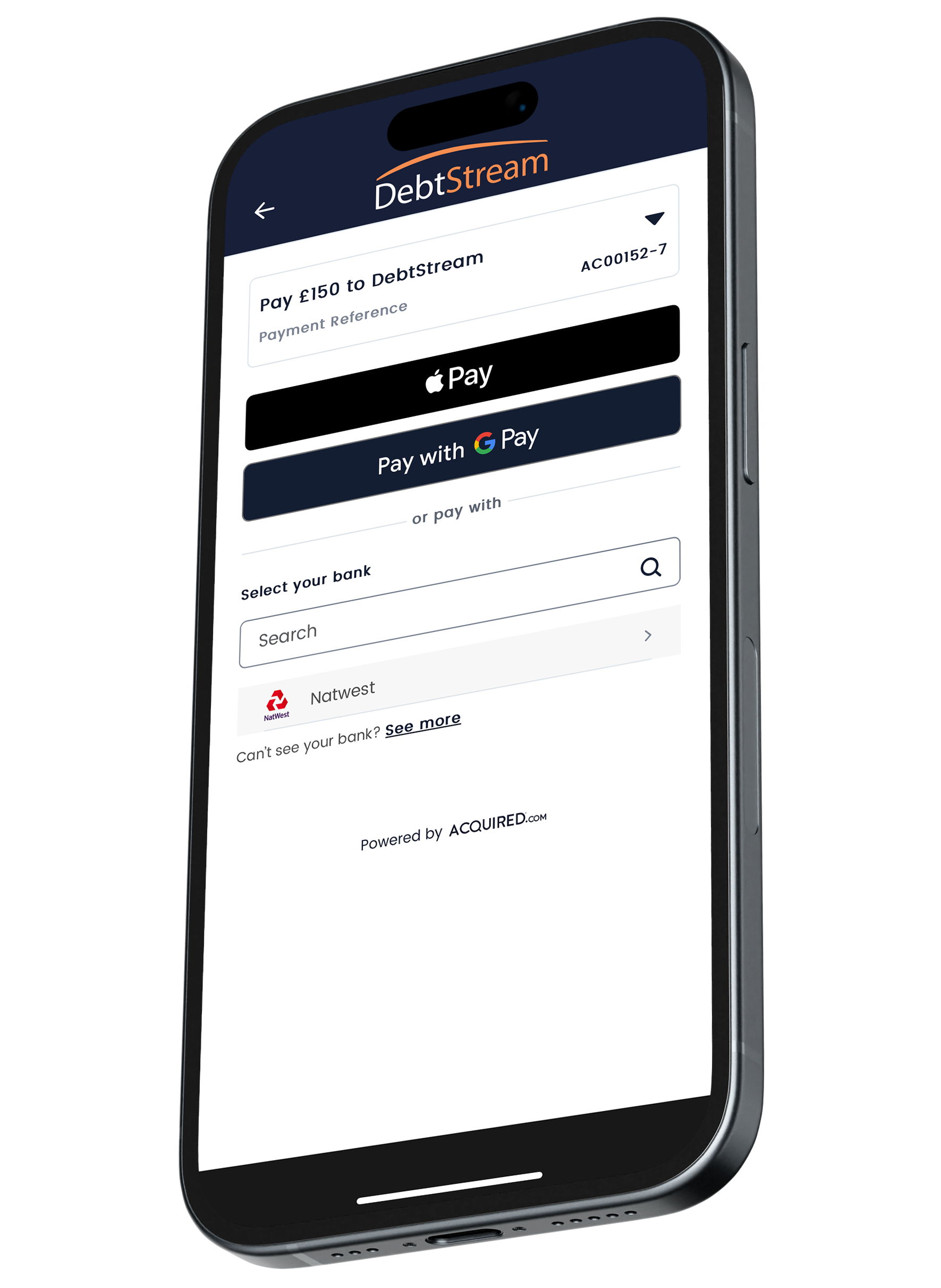

You can see a high level view of the payment micro journey below, or book a demo to have one of the team walk you through our micro journey product.

DebtStream #Microjourneys are focused on customer experience and making it easy for customers to engage, promoting the completion of a specific activity across the collections life cycle.

Leveraging Microjourneys can help you create a customer-centric collections strategy –

Collections, Made Digital

By submitting this form, you agree to hear from DebtStream about our products and services (as per our terms and conditions and privacy policy). You can unsubscribe at any time.

By submitting this form, you agree to receive promotional messages from DebtStream about its products and services (as per our terms and conditions and privacy policy). You can unsubscribe at any time by clicking on the link at the bottom of our emails.

Collections, Made Digital

By submitting this form, you agree to hear from DebtStream about our products and services (as per our terms and conditions and privacy policy). You can unsubscribe at any time.

Read our case study

By submitting this form, you agree to receive promotional messages from DebtStream about its products and services (as per our terms and conditions and privacy policy). You can unsubscribe at any time by clicking on the link at the bottom of our emails.