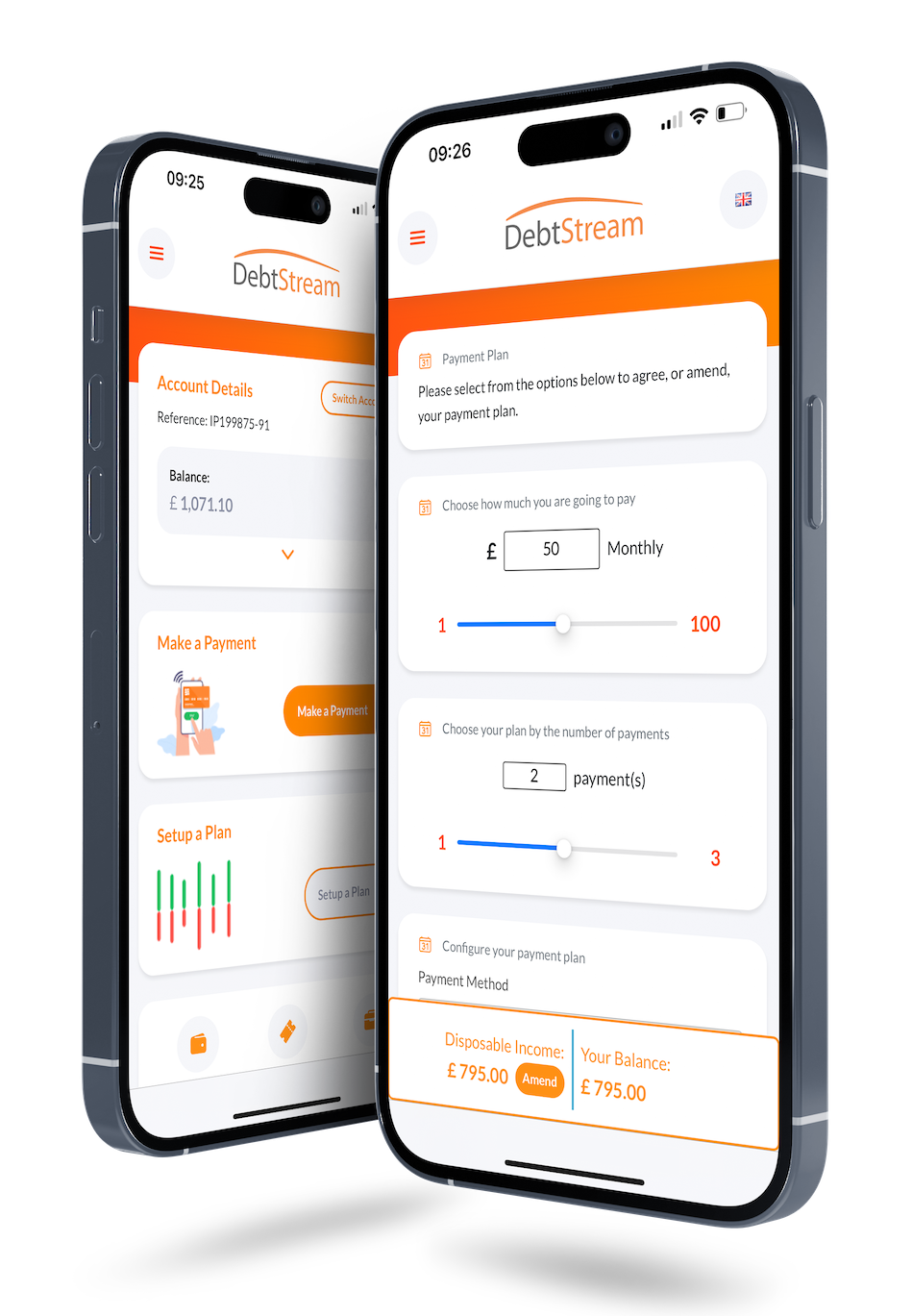

Streamline your collections capabilities with our white label platform, providing complete end-to-end digital self-service for collections and recoveries.

Streamline your collections capabilities with our white-label platform, providing complete end-to-end digital self-service for collections and recoveries.

Digital communication is more important than ever within the collections and recoveries sector where customer engagement is at a premium. Recent data has shown that we have jumped forward about 5 years in consumer and business digital adoption since the start of the COVID pandemic.

The latest insights suggest that 75% of ‘new digital’ adopters will continue to use digital channels and this wave of ‘new digital’ customers will create a new expectation from consumers who will demand the ability to engage digitally.

of adults in the UK own a smart phone (aged 16-64).

make online purchases and pay bills online.

of UK population are now using online banking.

The benefits of our products and services are extensive, the main areas are summarised below.

Improved experience, giving customers the tools to take control of their financial situation.

Bringing a better experience for your customers in collections, through digital engagement in your brand.

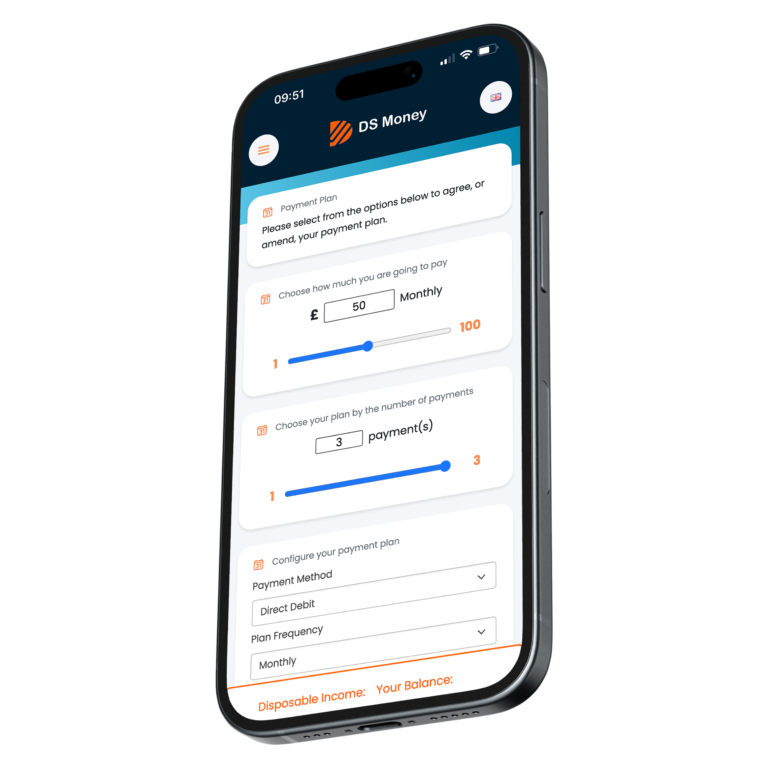

Code driven compliance and high configuration ability to adapt to changes.

Our platform allows you to take control of rules and the experience presented to your customers, enabling your strategy to continuously evolve.

Enabling your customers to self-serve will reduce the demand and effort required in your operation, saving FTE and operational cost.

Customers are choosing digital as a preferred way to engage. Revenue currently lost through traditional channels can be gained through the improved engagement that our digital products will provide to your customers.

You can have a high level view of the platform below, or book a demo to have one of the team walk you through the platform.

How a Legal Services Giant achieves a 20% Increase in monthly gross collections.

“ After a wide review of the market, we embedded the DebtStream platform in our business and it has enabled us to drive higher collections rates and take on more accounts with no increase in resources while providing our customers with a far better experience when dealing with our company. ”

Managing Partner, Legal Services Firm

“ After a wide review of the market, we embedded the DebtStream platform in our business and it has enabled us to drive higher collections rates and take on more accounts with no increase in resources while providing our customers with a far better experience when dealing with our company. ”

Managing Partner, Solicitor Firm

2 Hilliards Court, Chester Business Park, Chester

Collections, Made Digital

By submitting this form, you agree to hear from DebtStream about our products and services (as per our terms and conditions and privacy policy). You can unsubscribe at any time.

Read our case study

By submitting this form, you agree to receive promotional messages from DebtStream about its products and services (as per our terms and conditions and privacy policy). You can unsubscribe at any time by clicking on the link at the bottom of our emails.

Collections, Made Digital

By submitting this form, you agree to hear from DebtStream about our products and services (as per our terms and conditions and privacy policy). You can unsubscribe at any time.

By submitting this form, you agree to receive promotional messages from DebtStream about its products and services (as per our terms and conditions and privacy policy). You can unsubscribe at any time by clicking on the link at the bottom of our emails.