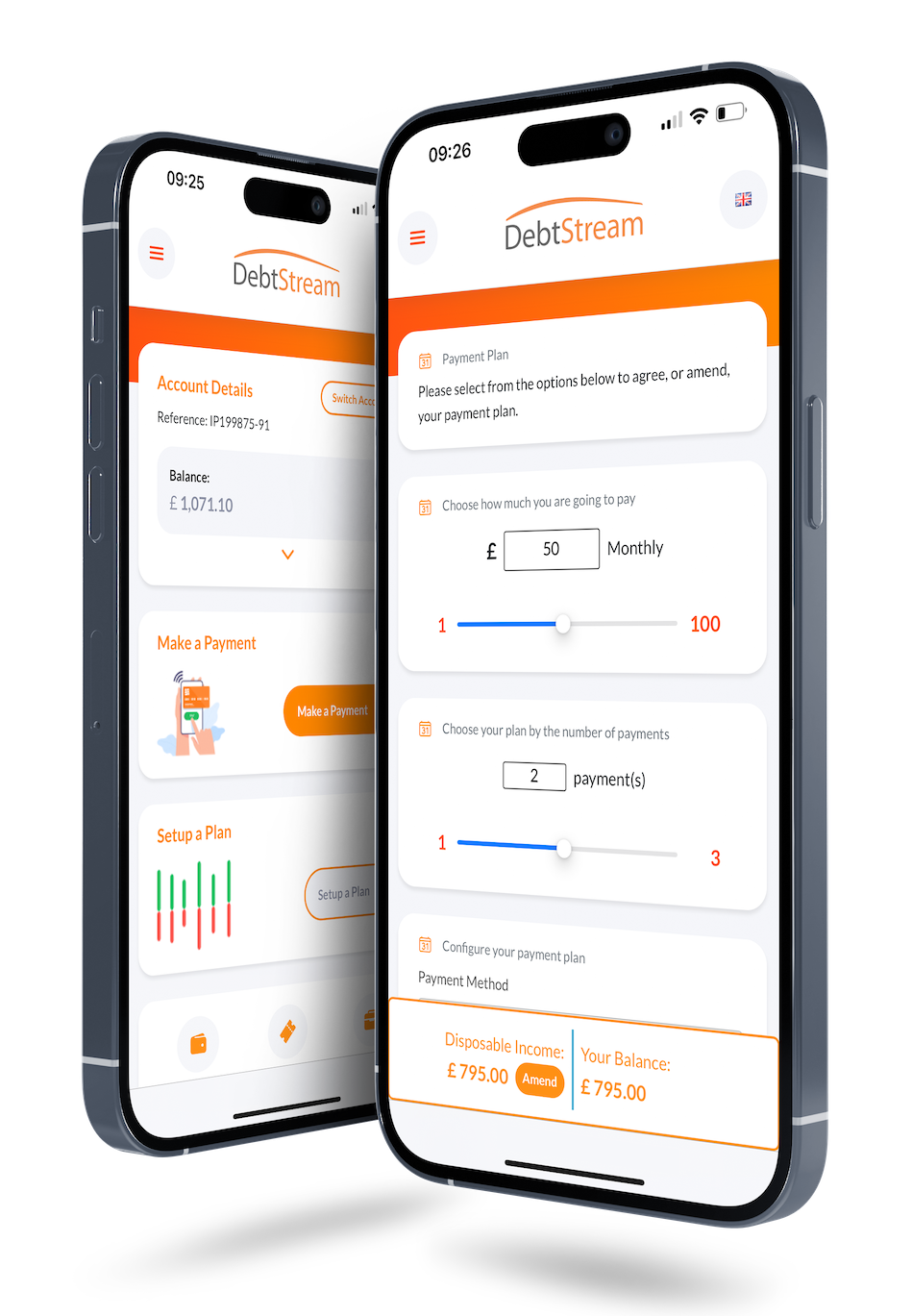

Self-Service Digital Collections Platform

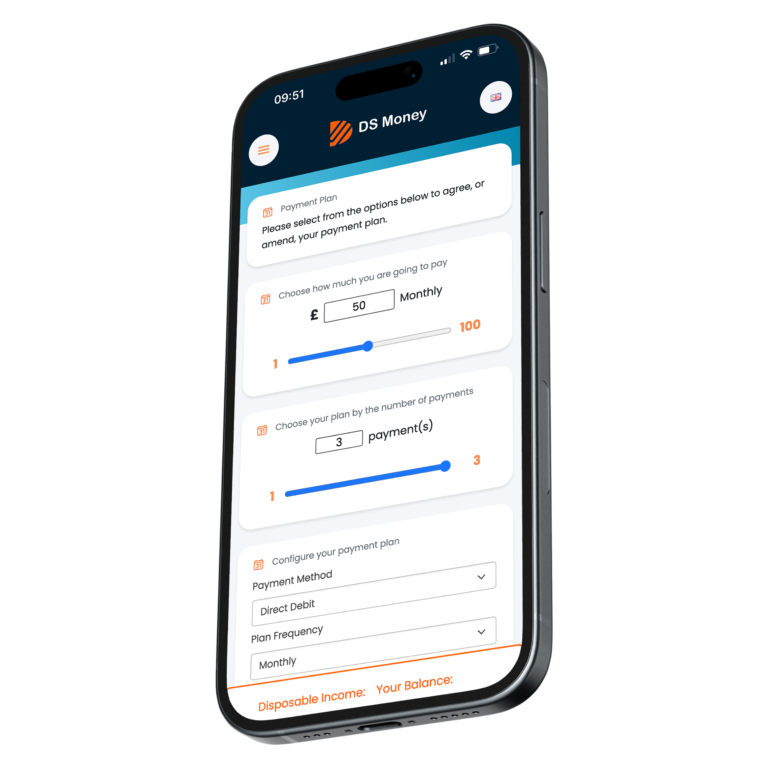

A digital ‘self-service’ debt collections platform, enabling any businesses carrying credit, such as debt collection agencies, lenders, and utilities providers, to engage with their customers online under their own brand. Feature rich platform with a firm focus on user experience.

- Drive dynamic messaging for customers to drive engagement across the collections lifecycle.

- Make payments, through card, Open Banking and other methods.

- Complete an income and expenditure assessment to understand the customer's affordability, linked to Open Banking.

- Setup a payment plan to help the customer get back on track.

- A range of other self-service options to drive digital engagement within collections and recoveries.

- Personalise your customers experience, driven by data.

- Designed based on substantial collections industry experience.